This short documentary highlights the importance and impact of solar energy on Haiti. In a country where 80% of the population doesn’t have access to electricity, solar energy is the clear solution.

The Promise of Energy Lending for MFIs in India, Delhi 2017

On December 11, Arc Finance and its partners participated at the 2017 Inclusive Finance Summit India, where leading MFI practitioners described their journey into energy lending under the USAID-funded PACE-D MSP initiative. The MFI leaders touched on both the challenges and opportunities they faced and the strategic choices they made along the way.

Microfinance as an Effective Channel for Accelerating Energy Access, Delhi 2017

On December 4, Arc Finance hosted the Microfinance as an Effective Channel for Accelerating Energy Access stakeholder meeting in Delhi, India.

Microfinance institutions (MFIs) offer innovative financing mechanisms that make clean energy systems affordable, and their client networks mean they can reach millions of people. With the right support, MFIs can provide clean energy access to the millions of people in emerging economies in Asia and around the world that do not currently have access in a sustainable and commercially viable way. MFIs are ideal partners for governments, nodal agencies and policy makers that want to rapidly scale energy access.

The PACE-D TA Program works with several MFIs, energy solution providers, and other stakeholders to facilitate and scale up financing for energy access. To date, the Program has reached over 1.78 million household members across nine states in India.

The event showcased the success of the PACE-D partners in energy finance and highlight the keys to making energy access work through MFIs. The panel discussion featured three of the seven MFI partners that have received TA under the PACE-D TA Program and illustrated how investment in these MFIs can further scale their existing programs and support the Government of India’s goal of 24/7 energy for all.

Arc Finance, Its Friends and Partners Mobilize to Support Hurricane Relief in Puerto Rico

The Arc Finance team, like so many others, was horrified at the catastrophic damage caused by Hurricane Maria, and has sought to contribute to the coordinated response by mobilizing several of its friends and partner organizations in the off-grid energy space to provide over 5,000 solar lighting products to Puerto Rico.

ReadTo this end, Arc reached out to the Sierra Club, a US-based environmental protection organization, as well as various product manufacturers including d.light, MpowerD, Greenlight Planet and EKOTEK, to coordinate the logistics, including financing, sending and distribution, of solar lights to the capital San Juan.

EKOTEK, a Haitian energy company, and Sogexpress (a money transfer company based in Haiti), both Arc Finance partners, enthusiastically joined this initiative, immediately launching a ‘rapid response’ shipment of 4,300 high quality, durable solar lighting systems with strong luminosity and mobile charging capacities, that arrived in Puerto Rico in the middle of November. In addition, MpowerD and d.light sent 983 and 200 portable solar lighting products respectively.

The Sierra Club was integral to this initiative with its engaged donor base and extensive network. It has frequently assisted in the delivery and on-the-ground support to local communities in the aftermath of natural disasters, including those exacerbated by climate change. Arc’s key contribution was its sector-building network capacity, ensuring that all the key players were mobilized quickly and connected so as to achieve immediate impact.

Stephan Nasr, CEO of EKOTEK, said: “When we were contacted by Arc Finance and the Sierra Club, we saw we were in a position to help and we acted on it. We want to show that there are companies in Haiti and other developing markets that are evolving along with the technologies we offer. We want to show solidarity with the people of Puerto Rico, and to demonstrate too that companies like ours care about the positive impact that our products can have. We are right here next door and we are in a position to organize and help quickly.”

Niki Armacost, Arc’s Managing Director said she was grateful that Arc’s friends were willing to coordinate so quickly in an unusual reversal of typical relief support: “This is a remarkable response: two organizations from Haiti - the poorest country in the Western Hemisphere - mobilize to help citizens of one the richest countries on earth who are facing enormous hardships right now. Solar lighting products are a godsend for those who are without power. They make people feel safe, they help businesses re-start, they prevent dependence on dangerous and dirty alternatives, and even help doctors and nurses save lives.”

She added that Arc was grateful to its friends at the Sierra Club, EKOTEK, Sogexpress d.light and MpowerD who rallied together and were willing to step up to help those whose lives are in ruin after this disaster. Efforts are continuing with other donors, energy and water filtration companies who have pledged to provide yet more assistance. Niki expressed Arc’s hope that this response could set a precedent for partnership between energy companies and others to channel immediate help to those suffering as a result of natural disasters, especially those caused by climate change.

Financing to Capture the Sun

A profile of the impact that our partner SolarNow has made through its asset finance work in Uganda and Kenya.

Closing the Financing Gap: Upcoming Solutions and Challenges for the Rural Poor, Washington, D.C. 2017

On Tuesday, October 25, 2017, Bicycles Against Poverty and the Bucknell Alumni Club of DC will host an event in Washington, D.C. centered around social enterprises and financial inclusion, with a focus on Sub Saharan Africa.

Arc’s Managing Director Niki Armacost discusses financial innovations in securing consumer financing for clean energy products and services for energy poor communities around the world.

Register for this event here.

ESAF Small Finance Bank: Pioneering a Retail Distribution Network Through Financing Clean Energy, Webinar, October 2017

In India, energy access is a huge challenge; 80 million households have little or no access to grid electricity due to the limits of grid penetration and the geographies in which they live. Providing quality, safe and reliable alternatives to kerosene and other traditional fuels means addressing two main challenges: distribution and affordability.

This webinar was based on the recently published case study on the energy lending program of ESAF Small Finance Bank, one of the seven MFI partners receiving TA from the PACE-D TA Program. The webinar will share the insights and knowledge gained under the Program for a broader audience in India and beyond including MFIs, renewable energy companies, donors and investors.

ESAF began as the Evangelical Social Action Forum, which expanded to include ESAF Microfinance and, in 2017, it became ESAF Small Finance Bank. Working in states where solar penetration across rural and peri-urban markets is growing due to the inconvenience of the inconsistent grid, ESAF is a genuine pioneer in the Indian clean energy finance sector. It has an extraordinarily broad retail offering that ranges from solar home systems and water purifiers to washing machines, offered with a loan model and cross-selling strategy that makes the company as much an asset financer as a microfinance institution.

In this way, ESAF is one of the most important players in the distributed renewable energy sector – an early mover, with its clean energy business operated through the broad ESAF retail distribution network, and now with a Small Finance Bank licence, which means reaching a wider network of new customers.

This webinar addressed ESAF’s energy finance program, how the PACE-D TA Program has worked to scale up ESAF’s energy finance program, the outcomes and lessons learned from this initiative, and ESAF’s future plans. View webinar here: http://bit.ly/ESAFwebinar.

Sarala Development and Microfinance: An MFI Scales Up Energy Lending, Webinar, June 2017

If you were unable to join us for this webinar discussion on June 30, 2017, you can view the recording here.

Microfinance institutions (MFIs) are ideally positioned to solve the challenges of energy distribution and energy affordability. They can offer innovative financing mechanisms that make lighting systems affordable, and, because of their client networks, can reach millions of people. At the same time, by offering energy loans, MFIs are able to diversify their portfolios and develop new business channels.

This webinar is based on the recently published case study on the energy lending program of Sarala Development and Microfinance, one of the seven MFI partners receiving TA from the PACE-D TA Program. The webinar will share the insights and knowledge gained under the Program for a broader audience in India and beyond including MFIs, renewable energy companies, donors and investors.

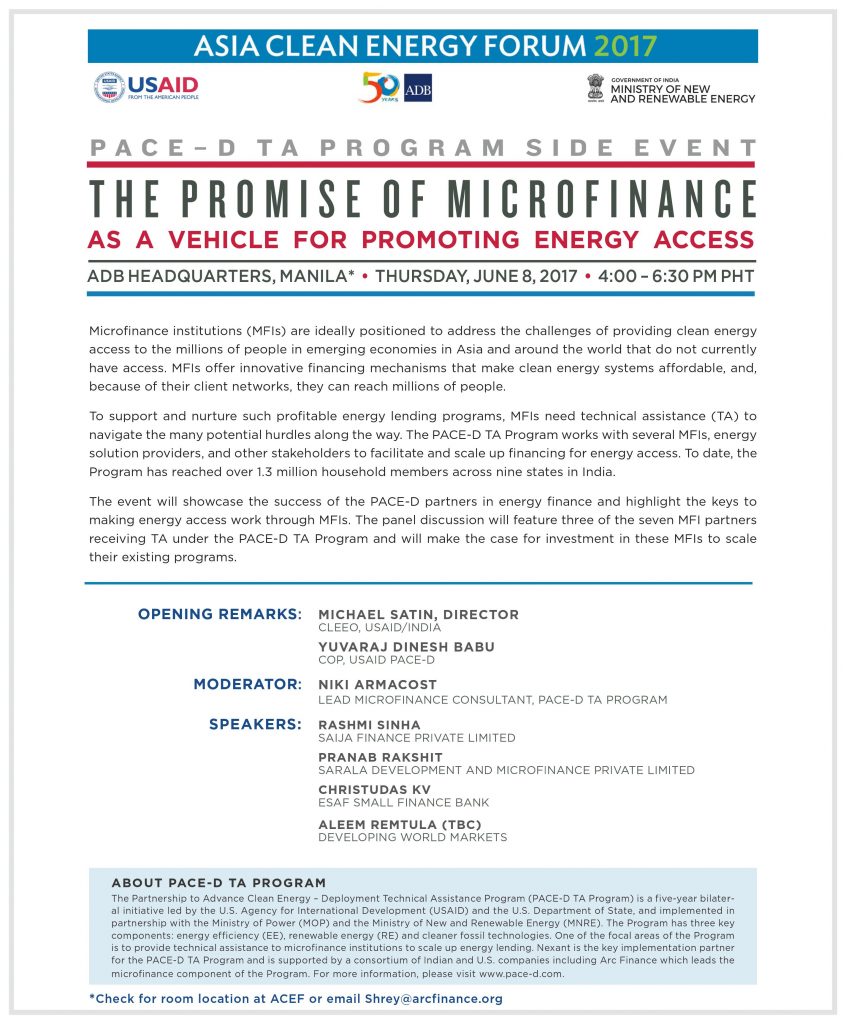

Asia Clean Energy Forum, Manila, 2017

Join us for a PACE-D TA Program side-event discussion on “The Promise of Microfinance as a Vehicle for Promoting Energy Access” on Thursday, June 8, 2017 at 4:00 p.m. PHT.

This event will feature remarks from Nithyanandam Yuvaraj Dinesh Babu, Chief of Party, USAID PACE-D Program and Nicola Armacost, Managing Director of Arc Finance, who will outline the estimated market size, business case for energy lending and investment opportunities.

In addition, this event will feature a panel of three microfinance practitioners-Pranab Rakshit from Sarala Development and Microfinance P Ltd., Christudas kv of ESAF Small Finance Bank and Rashmi Sinha of Saija Finance Private Limited-who will share their perspectives on how MFIs are demonstrating the opportunity and what is now needed to scale the existing programs further.

More details can be found in the flyer below.

People Power: How Saija’s Energy Lending Program Innovates, Webinar, April 2017

If you were unable to join us for this webinar discussion on April 27, 2017, you can view the recording here.

This webinar is based on the recently published case study on the energy lending program of Saija Finance, one of the seven MFI partners receiving TA from the PACE-D TA Program. The webinar will share the insights and knowledge gained under the Program for a broader audience in India and beyond including MFIs, renewable energy companies, donors and investors.

In India, energy access is a huge challenge; 80 million households have little or no access to grid electricity due to the lack of grid access in certain geographies. Providing quality, safe and reliable alternatives to kerosene and other traditional fuels means addressing two main challenges: distribution and affordability.

Microfinance institutions (MFIs) are ideally positioned to solve both of these challenges. They can offer innovative financing mechanisms that make lighting systems affordable, and, because of their client networks, can reach millions of people. At the same time, by offering energy loans, MFIs are able to diversify their portfolios and develop new business channels.

To develop profitable energy lending programs, MFIs need technical assistance (TA) to navigate the many potential hurdles along the way. The PACE-D TA Program works with several MFIs, energy solution providers, and other stakeholders to facilitate and scale up financing for energy access. To date, the Program has reached over 1.3 million household members across nine states in India.

DC Solar Products are Lighting Up Rural India: What’s Driving the Increased Demand?

Firstpost. Read article.

Sustainable Energy for All Forum, New York, 2017

Arc’s Managing Director Nicola Armacost participated at the 2017 Sustainable Energy for All Forum in New York. During the event kicking off the launch of the Energy Access Practitioner Network online survey, Niki addressed the need for comprehensive, well thought out strategies for financing clean energy. On the Forum’s last day of activities, Niki shared her experiences of how energy practitioners are pushing boundaries and creating opportunities that result in broader economic and development gains. Niki focused her discussion on the ways that women are gaining agency through control and usage of clean energy products, as well as challenges entailed in working with this demographic.

University of Pennsylvania Microfinance Conference, Philadelphia 2017

Arc’s Managing Director Niki Armacost participated at this year’s University of Pennsylvania Microfinance Conference, the first undergraduate microfinance conference in the United States.

The annual conference explores the myriad of ways that microfinance has contributed to economic development in terms of product offerings and lending methods in the wake of increased government regulation and immigration crises. This year’s conference showcased the experiences of microfinance practitioners as they addressed their research, successes and challenges in the field. Niki Armacost discussed the impact Arc has made in empowering women in India and Haiti to take more active roles in their households and the financial and energy literacy program that Arc is developing in India.

Uganda: Solar Energy for All

USAID Development Credit Authority Exposure Story. Read article.

Commission on the Status of Women 61 Event, New York 2017

Join us as at our second Commission on the Status of Women side event in New York on March 23 at 10:30 a.m. Organized in conjunction with USAID, this panel event will discuss “Access and Women’s Work: Women Entrepreneurs and Energy Financial Literacy”. Register at [email protected].

Nepal Microfinance Summit, Kathmandu 2017

Arc participated at the 2017 Nepal Microfinance Summit held in Kathmandu, Nepal. Drawing on the impact that Arc has achieved in developing effective end-user financing mechanisms in India, Arc team members Aashish Chalise and Saurav Timilsina spoke on a panel moderated by Dr. Govinda Pokhrel and discussed their insight and experiences on energy financing and the critical role that microfinance institutions can play in this sector.

Aashish Chalise, far left, and Saurav Timilsina, far right, discuss energy financing insights.

Energy financing panelists (Aashish Chalise, second from left, and Saurav Timilsina, far right)

IFC Lighting Myanmar, Myanmar 2017

Arc participated at this year’s Lighting Myanmar conference, hosted by IFC. Speaking on a panel entitled “Energy Financing Experiences from India”, Arc team member Shrey Bairiganjan highlighted how Arc is supporting its partners develop effective end-user financing mechanisms in India and detailed Arc’s technical assistance approach. Providing data on low electrification rates in Myanmar, he presented data that can be used to support how microfinance institutions offer an effective gateway for delivering renewable energy systems at scale in Southeast Asia. Moreover, he discussed in detail how the MFI energy lending business models emerging in Southeast Asia and how MFIs can maintain financial solubility with two revenue streams.

Making Better Living, One Solar Sale at a Time

USAID Frontlines. Read article.

Medium. Read article.

U.S. Department of State Official Blog. Read article.

SolarNow Raises €150,000 to Expand Solar Home Systems Market in Uganda

Energy4Impact. Read article.

Arc Finance Hosts Workshop in Haiti on Renewable Energy Finance

The Arc Finance team was in Haiti this week, to co-host a workshop entitled Scaling the Delivery of Clean Energy Through Diaspora Engagement and Agent Sales, which presented to a broad audience of stakeholders the components, business models, results and lessons from Arc’s work with Haiti Money Transfer Organization Sogexpress.

ReadHeld at Hotel Karibe in the capital, the workshop was an opportunity to shine a light on Arc’s partnership with Sogexpress which features both a remittance financing model and an agent trade finance mechanism that address issues of energy poverty and affordability as well as distribution challenges. The workshop was opened by Arc’s Managing Director Niki Armacost, and the Executive Director of Sogexpress Dominique Policard, who described the four-year program’s evolution, made possible by technical assistance funded by the Multilateral Investment Fund (MIF), a member of the Inter-American Development Bank Group, and USAID, and implemented by Arc Finance. The initiative leverages both the US-Haiti remittance corridor through the creation of a dedicated online platform, www.KlereAyiti.com, that enables Haitians in the diaspora to send solar lights to relatives in Haiti, and also the Sogexpress distribution network in Haiti by selling products through their stores and the network of agents across the country. In fact, this initiative has piloted a consignment trade finance model enabling agents to sell solar lighting products within their local communities in Haiti.

The workshop was opened by Arc’s Managing Director Niki Armacost, and the Executive Director of Sogexpress Dominique Policard, who described the four-year program’s evolution, made possible by technical assistance funded by the Multilateral Investment Fund (MIF), a member of the Inter-American Development Bank Group, and USAID, and implemented by Arc Finance. The initiative leverages both the US-Haiti remittance corridor through the creation of a dedicated online platform, www.KlereAyiti.com, that enables Haitians in the diaspora to send solar lights to relatives in Haiti, and also the Sogexpress distribution network in Haiti by selling products through their stores and the network of agents across the country. In fact, this initiative has piloted a consignment trade finance model enabling agents to sell solar lighting products within their local communities in Haiti.

In the second session, entitled Rationale, Core Components and Business Models, Niki walked the audience through the goals of the initiative, including:

- To allow Haitians in the diaspora to provide solar products to their families via KlereAyiti.com;

- To expand access to solar products in Haiti through the Sogexpress network of flagship stores and agents; and

- To provide Sogexpress agents with a new business opportunity through a consignment model that enables them to sell solar products.

Niki explained that the initiative provides market-based solutions to the energy crisis in Haiti, it promotes renewable energy for even some of the poorest Haitian households, it creates jobs in Haiti, both for Sogexpress staff and the network of agents, and it engages the diaspora. This new commercial business model has raised consumer awareness about clean energy in Haiti, as well as the resulting economic, health, and social benefits.

The remittance model, called ‘Klere Ayiti’ – “Light-up Haiti” in Creole – is a platform that responds to a unique context where only 28% of the population has access to electricity, and where remittances represent over 26% of GDP. To marry this supply and demand, the platform features a dedicated website that allows local customers and senders living abroad to order the solar light kit of their choice. Orders are fulfilled by Sogexpress in three to five working days.

The other main component of the initiative, the consignment finance model, involves a nation-wide agent network which assists in the important job of awareness-building, especially in terms of the financial benefits of switching to solar from traditional fuels.

In the third session, entitled Results, Arc’s Haiti project lead Yara Akkari and Dominique summarized the impact of the programs so far, including the sale of over 86,000 solar devices, benefitting more than 430,000 people, and the creation of thousands of jobs for solar entrepreneurs.

Finally, Niki summarized many of the lessons learned, recommendations and next steps for the initiative, and Sogexpress Executive Vice President Franck Lanoix closed the workshop with an enthusiastic assessment of the present and future of the initiative. “At Sogexpress we want to help all Haitians benefit from our natural resource – an abundance of sunlight. With these solar lights children can study at night, families will feel more safe and secure, businesses can stay open longer and people can charge their phones. Having a cleaner and more accessible alternative for electricity with the solar lights has the potential to transform the lives of millions of Haitians,” he said.

One for All, Mumbai 2017

Arc participated at the One for All workshop in Mumbai, India. The workshop was attended by key sector stakeholders, such as CLEAN and the Wallace Global Fund. Speaking on a panel entitled “Finance and Policy Context for Clean Energy Access in India”, Arc team member Shrey Bairiganjan highlighted the various energy lending initiatives Arc is engaging in on the Indian sub-continent. Friends from Simpa Networks and Frontier Markets affirmed the significance of scaling energy lending across India and other countries.

Financing Commercial Sales of Solar Water Pumps to Smallholders, Nairobi 2017

Arc participated at Winrock International’s “Financing Commercial Sales of Solar Water Pumps to Smallholders” workshop in February at the Intercontinental Hotel in Nairobi, Kenya. The workshop featured a spectrum of stakeholders, ranging from investors and manufacturers to practitioners and solar pump farmers. Speaking on a panel called “How to Expand Solar Pump Lending to Smallholders”, Arc team member Micaela O’Herron shared her experience with solar pump pilot projects in India and provided perspective on scaling up solar lending in India.

Sogexpress Promotes Solar Energy in Haiti

Le Nouvelliste. Read article.

African Diaspora Network Symposium, Silicon Valley 2017

Arc’s Project Coordinator Yara Akkari made her second annual appearance at the African Diaspora Network Symposium in Silicon Valley in January. During a TED Talk-format on “Africa’s Growing Startup Ecosystem” where entrepreneurs and investors active on the African continent explored the startup ecosystems in Africa, Yara showcased the rapid growth and innovation that Arc’s partners in Kenya and Haiti are witnessing.

Yara Akkari, center, at the African Diaspora Network Symposium

Yara Akkari looks on as her panelist discusses the African startup ecosystem

CLEAN’s India Clean Cooking Forum, New Delhi 2016

Niki Armacost, Arc’s Managing Director, participated at CLEAN’s India Clean Cooking Forum on December 5, 2016 in New Delhi, India. Niki shared her insight into the renewable energy sector in India during a panel discussion entitled “Setting the Context: Looking Back and Looking Ahead”.

Inclusive Finance India Summit, New Delhi 2016

Niki Armacost, Arc’s Managing Director, participated at the Inclusive Finance India Summit on December 6, in New Delhi, India. Niki discussed her experiences in the renewable energy lending space and the accomplishments of the REMMP and PACE-D initiatives during a session entitled “Catalyzing Small Finance: For Quality of Life Projects”.

Winrock International Enhancing Capacity of Women Micro-entrepreneurs to Sell Clean Energy Products, Washington D.C. 2016

Niki Armacost, Arc’s Managing Director, attended Winrock International’s Enhancing Capacity of Women Micro-entrepreneurs to Sell Clean Energy Products on November 16, 2016 in Washington DC. At the conference, Niki joined a panel discussion on “Innovations in Supporting Women Entrepreneurs in and Beyond the Energy Sector: Case Studies”, where she highlighted Arc’s work with women entrepreneurs in India, Haiti and Nepal.

The Energy Diaries and What They Mean for Investors: An Arc and MFO Webinar with GIIN

On Friday November 4th, Arc Finance and Microfinance Opportunities presented the findings from the first phase of the Energy Diaries project on webinar hosted and organized by the Global Impact Investing Network, or GIIN.

ReadThe ‘Diaries’ have generated huge interest since the research phase of the project finished in late 2015, with the results presented at conferences in Washington DC (to USAID staff), in New York (to a wide range of investors and other stakeholders in the energy finance space), in Delhi (to a large audience of Indian practitioners, investors and policy-makers), and through another webinar back in June, to a global audience.

This time, GIIN invited Arc to present to GIIN’s own investor base, many of whom are involved either in renewable energy or financial inclusion, but few of whom will be involved in the end-user finance of distributed renewable energy products, and the lives of the rural poor who need to access that finance.

How the Rural Poor Buy, Use and Think About Energy was the theme of the presentation, and describes very clearly what the Diaries are about. Developed under USAID’s Renewable Energy Microfinance and Microenterprise Program (REMMP), the Energy Diaries took place across three rural sites in India. It is an adaptation of the now-well trodden Financial Diaries methodology, and involved studying energy usage and spending at the household level to improve understanding of the daily realities of being energy poor; the types of energy sources people choice and why; how energy poverty may impact women and men differently; what gendered needs suggest about optimal energy products and services for this market; and what are the relevant policy implications for stakeholders to better meet the needs of poor households.

Each diarist – most of them women – kept a daily record of all household expenditure, energy transactions (including purchases, sales or gatherings), the usage of different energy sources, and the activities that those energy usages made possible. The daily diaries were supplemented by weekly interviews with trained researchers in the field, and after all data were collected (over 40,000 cleaned data points – a veritable treasure trove of original research), a series of qualitative Focus Group Discussions took place in the field with many of the project’s respondents.

From this emerges an unprecedented – although still incomplete – look at the energy lives of the rural poor, including their use of Distributed Renewable Energy (DRE) products like solar lanterns and home systems.

After an introduction by GIIN’s Allison Spector, Arc Finance Managing Director Niki Armacost walked attendees through the background, remit, methodology, enrollment data on energy expenditure as a percentage of overall household income, the electrification rates and energy sources reported by households, and top level findings of the research, including:

- That households are developing energy portfolios;

- That creation of an energy portfolio is driven by household income and expenditures, social/geographical context and family customs; and

- That there are clear benefits in providing clean energy, especially increased reliability and larger marginal benefits for women.

Niki then handed over to Guy Stuart, Executive Director of Microfinance Opportunities, Arc’s project partner, to dig a bit deeper into how the data revealed these findings. Guy walked the attendees through some individual household case studies, fuel usage by income segment and age, prevalence of energy usage by source and location, and comparisons of solar versus non-solar households in terms of overall energy access.

As they both put it, the Diaries showed, like the households in the original financial diaries research, the energy lives of the rural poor are sophisticated and complex. Instead of the “ladder” notion of energy – in which households move up in discrete shifts from one traditional fuel source to a cleaner, better and more expensive fuel, families above a minimum income threshold manage an energy portfolio, driven by cost and availability of energy sources/ devices. Families buy, gather and use a range of energy sources for cooking, lighting and mechanical power. They mix and match “traditional” and “modern” energy sources to maximize their utility in a similar way to how they manage their financial portfolio.

But this is driven not only by respondents’ income and expenditures, but also by context, cultural factors and family customs – such as for example the preference among households with older people present for solid fuel like dung and wood for cooking, over cleaner and more modern cooking fuels such as LPG.

In terms of lighting, most households have some basic access to the electricity grid, but they seldom pay for it, and it is almost always unreliable. By contrast, the Diaries and the follow-up focus groups illustrated that while solar has its limitations in what it can power, households with solar lighting value its reliability, versatility and simplicity of use above all.

These attributes are disproportionately felt by women, too – the primary users and beneficiaries of improved lighting, irrespective of who the client of the financing institution is, or who ‘owns’ any product. The Diaries in fact provided welcome support for the arguments made by Arc, USAID and others in the sector for a long time – that providing finance for clean energy has enormous benefits for women, in terms of health, time management, and their ability to oversee their children’s education – an irrefutable theme from the study.

But DRE providers like asset finance companies or microfinance institutions doing solar energy lending face significant obstacles, not least that they are “competing against free”, as Niki put it. Grid energy is often obtained by end-users at no cost, and traditional fuels are heavily subsidized, making market penetration challenging.

But this challenge is only one of the many implications of the research for different stakeholders, and Niki finished the webinar presentation by summarizing the implication for financial institutions, donors and policy-makers, energy companies, and – perhaps most valuable for this audience – for investors.

Paul Needham is CEO of Simpa Networks – an asset finance company selling solar home systems and fans in India through a ‘progressive purchase’ finance model and one of the institutional partners in the Diaries research, and he joined us for the webinar. He outlined several ways he and his team have adapted their offering based on this better understanding of clients’ energy usage and activities, including marketing by women to women, based on women’s clear energy needs.

Finally, the webinar was opened up for audience Q&A, including on the challenges of making a pay-as-you-go business models work in challenging working-capital demanding contexts (especially as it concerns financial forecasting), and on the gaps in the research, and the prospects and potential subject scope for Energy Diaries II, perhaps to look at completely off-grid farmers, urban energy usage, and the seasonal patterns which this short pilot could not.

For those of you interested in more detail of the study, a fact sheet is available on the Arc website here, and a longer report is forthcoming. The Arc team would like to thank MFO, USAID, and of course GIIN for hosting this discussion, and bringing in such a high-level audience to hear the findings, and better think about the impact investment opportunities available in the distributed renewable energy sector.

Diasporas in Development, Washington D.C. 2016

Niki Armacost, Arc’s Managing Director and Saiful Islam, Arc’s Microfinance Specialist, attended USAID’s Diasporas in Development: Moving from Opportunity to Action on October 12 Washington D.C. During a break out session, the two, joined by Jeff Policard of Cool Ideas, shared best practices and lessons learned from their work in Haiti and Kenya.

Clinton Global Initiative, New York 2016

Niki Armacost, Arc’s Managing Director, attended the Clinton Global Initiative in September in New York. At a series of closed-door meetings, Niki addressed the need for sector collaboration and shared her experiences working to scale energy-lending in India, Uganda, Kenya, Nepal and Haiti.

Sogexpress’ Consignment Model Innovates in Inventory Supplier Financing for Solar Street Agents in Haiti

Haiti is the poorest country in the Western hemisphere and has some of the lowest levels of electrification in the world. To address this massive shortfall in access to quality and reliable energy, Haitian Money Transfer company Sogexpress, has made a commitment to radically increase access to clean energy products.

ReadThe vehicle Sogexpress has chosen to achieve this goal is through its agent network, especially its street agents. To test the initial viability of this approach Sogexpress introduced a pilot to encourage 340 of its 1,000 street agents to sell solar lanterns. Sales were strong, but the test demonstrated a need for a source of supplier credit to finance the inventory the agents planned to sell.

Market research conducted by Arc Finance in 2014 indicated that the consignment model was the best financial mechanism for this pilot: as it lowers risk for the agents and Sogexpress as compared to a more formal loan product. Sogexpress was not prepared to bear the risk of handing over large amounts of inventory without some sort of guarantee, and the agents were uncomfortable borrowing money to purchase inventory for new, unfamiliar products and carry the risk until those products were sold.

So Sogexpress, with the assistance of Arc Finance, the IDB’s Multilateral Investment Fund and United States Agency for International Development (USAID), spent several months developing the consignment mechanisms, structure and policies. It also upgraded and adapted the Sogexpress IT and Management Information Systems to ensure they were fit for the purpose of tracking the credit and status of agents.

Towards the end of 2015, Sogexpress started implementation of its retail consignment program. The agents or shop retailers don’t have to purchase the products they sell. Instead, the company lends them its products on “consignment”, which allows Sogexpress to increase the working capital of its street retailers, diversify its portfolio, and expand its business and increase revenues.

A background check and selection process involving several steps mitigates the risk of lending. Firstly, Sogexpress’ démarcheurs (trusted senior agents) identify prospective street agents and recruit them. Next, store managers create and evaluate files on each potential agent. The store manager interviews selected candidates. The store manager registers the approved agents, and sends their files to the selection Committee. Once the Committee approves an agent’s application, the street agent signs a consent form. This form describes the agent’s commitment, duties and responsibilities in detail.

The new agent pays a 300 HTG (approximately US$5) deposit to a Sogexpress store manager to be enrolled in the consignment “Loyalty Program” and receives a special “loyalty card” as identification of membership. This program has various objectives, including: to track sales data and agents’ performance; to allow agents to accumulate loyalty points; and to track consignment portfolio quality, with an alert system in place to flag delinquencies or other problems.

After agents are registered, they are given a credit limit of 3,000 HTG (US$50), with which they can borrow energy products from the company (the value of approximately three solar products). Later, once the agent has demonstrated creditworthiness, he or she may receive a limit of up to 50,000 HTG (about US$900). Each new agent is given a kit that includes different models of solar lamps with a maximum value of 3,000 HTG (US$50), a branded backpack in which to carry the lamps, and flyers with descriptions of the products.

In order to support its new agents, Sogexpress provides marketing support through sound trucks and advertising. Training sessions based around product details and selling tactics further bolster the agents’ capacity to effectively engage with prospective customers.

As of August 31st 2016, Sogexpress has enrolled 561 agents in this program. In the summer of 2016, Sogexpress and Arc Finance conducted a first review of the pilot, collecting feedback and data to make the consignment process faster and easier. As the company moves forward, it is aiming to increase its efforts to retain active agents. Arc is helping Sogexpress to grow this program, and to reach its target of enrolling 1,000 agents by the end of the year – especially outside Port-au-Prince where the competition among energy companies is less intense. It is also in these rural areas where people are in the most need of reliable and safe lighting solutions, such as the solar lights for which this model is so well suited.

Dominique Policard, Executive Commercial Director at Sogexpress, foresees that:“This program has not only the advantage of facilitating access to clean energy but also of helping the street agents access financial services. Sogexpress is very proud of this new program and hopes to scale it in the future.”

Soge-EASY! Launch of Branchless Banking Product from Arc Partner Sogebank Can Help Bank Solar Energy Agents

For thirty years, the Sogebank Group, the parent company of Arc partner Sogexpress the leading money transfer and payment services company in Haiti, has been innovating in the banking market. From being an early mover with ATMs in the 1980s, to mobile banking this decade, the company has led the Haitian banking sector in improving the customer experience.

ReadYet, Haiti remains one of the most financially excluded markets in the hemisphere, with only 20 percent of Haitians having a bank account. To help address this, Sogebank has developed a new product called SogeIzi (pronounced Soge-EASY). SogeIzi is a savings model targeted at poor and rural Haitians. The target market includes street agents that sell solar lighting products on consignment with support made possible by technical assistance funded by the Multilateral Investment Fund (MIF), a member of the IDB Group, and USAID, and provided by Arc Finance.

Recognizing that like many other Haitians, many of these agents are financially excluded, Sogebank is offering them the possibility to save their income as well as make payments using a debit card (Izicash card). They will be able to use a range of locations within the broad Sogebank Group network (not just the brick-and-mortar Sogebank branches), including Sogexpress stores and ATMs. The clients benefitting from this program, including potentially many of Sogexpress’ solar agents, will be able to access a basic bank account, enabling them to save, earn interest and conduct transactions all over the country, in rural or urban areas, irrespective of whether there is a Sogebank branch nearby.

Simplicity is a hallmark of the program. Sogexpress believes it is important to make it as easy as possible for financially excluded customers to make financial transactions while keeping operating costs low. Accounts can be opened in 10 minutes, using a single identification document and a low initial deposit (HTG 300, or US$5). Customers are provided with a starter kit of an Izicash debit card, explanatory documentation, a PIN, transaction registration, and free enrolment in the Sogemobile (mobile bank account access) and other Sogebanking programs.

SogeIzi is particularly valuable for the agents selling solar lighting products under the program Arc has implemented with Sogexpress. The initiative helps to bring them into the formal financial sector with the associated advantages. It works in tandem with the consignment finance model, which provides solar products on credit to the agent. The extended opening hours of Sogexpress stores (including Saturdays, Sundays and holidays) compared to Sogebank branches is designed to accommodate the needs of clients such as agent entrepreneurs, as is the 24/7 access to their account and execution of transactions through ATMs, Sogebanking and Sogemobile.

As Dominique Policard, Executive Commercial Director at Sogexpress, describes it, this new product is timely, “enabling Sogexpress to take another step in supporting the network of sales agents to increase their livelihoods through financial access and by facilitating savings”. Policard says that the Sogebank Group wants to bring the financially excluded in Haiti into the financial sector, ensuring that even the very poor have access to basic and affordable financial services. This effort is particularly significant in Haiti, which is the poorest country in the hemisphere, with very low levels of financial access and literacy.

The agent consignment model launched by Sogexpress with the support of USAID, MIF/IDB and Arc Finance will benefit over 1,000 agents by the end of 2016. Hopefully many of these people will be able to benefit from the financial access and flexibility of this innovative new program. SogeIzi will be an important way to bring these entrepreneurs into the formal financial sector; enabling them to save, pay and transfer money safely, quickly and affordably as they build their businesses and bring quality clean energy to their customers.

Asia Clean Energy Forum, Manila 2016

Niki Armacost, Arc’s Managing Director, participated at the Asia Clean Energy Forum (ACEF) in Manila, Philippines in early June. She addresses the milestones of REMMP initiatives during her discussions at the “Reaching the Last Mile: Gender and Socially Inclusive Approaches for Energy Access” and “Business Models for Access that Spur Innovation” panels.

Ashden Awards, London 2016

Sam Mendelson, Arc’s Knowledge Specialist, represented Arc at the 2016 Ashden Awards for Sustainable Energy International Conference in early June. At a closed-door investors workshop, Sam discussed how investors and practitioners can partner to strengthen the sector.

Renewable Energy Microfinance and Microenterprise Program (REMMP) Benefits 1 Million People with Clean Energy!

We are delighted to announce that as of April 30th 2016, Arc’s USAID-funded Renewable Energy Microfinance and Microenterprise Program (REMMP) has passed the milestone of 200,000 sales of energy products. That equates to over 1 million people benefiting from clean energy in five countries – India, Uganda, Haiti, Kenya and Nepal.

ReadThe 200,000 customers – of which 67% are women – have received access to products such as solar lanterns, solar home systems (SHS) and efficient cookstoves under a range of consumer financing mechanisms which seek to bridge the affordability gap inherent in providing products like these to the poor. REMMP has also addressed distribution challenges posed by the “last mile” through promoting “supplier” financing mechanisms.

These financing mechanisms range from different microfinance loan models built and expanded under REMMP by Arc’s MFI partners, to asset finance offered by energy enterprises, remittances from migrants, and trade finance for agents conducting cash sales. Arc’s goal under REMMP remains to pilot, test, evaluate and scale different financing mechanisms for distributed renewable energy products (such as small-scale solar for off-grid households) and in doing so, pave the way for commercial scaling of this sector by demonstrating the viability of these models.

In order to facilitate sales, REMMP partners have disbursed over US$13 million in loans and over US$29 million in investment has been leveraged under the program. Over 37,000 tonnes CO2e has been displaced by the clean energy products sold and the equivalent of 2.1MW of solar capacity has been installed. A recent annual phone survey reveals 98% product satisfaction among clean energy customers, and 87% likelihood to recommend the product to friends or family.

After spending several years laying the groundwork through capacity building, partner and product evaluation, and all of the other critical steps to building local capacity – mostly from scratch – REMMP is seeing sales accelerating. In fact, the milestone of 100,000 clients reached was just passed in July 2015. REMMP expects even more rapid scaling in the coming months as the affordability gap for clean energy products continues to narrow through the hard work of our partner organizations.

SolarNow Attracts $2 Million Loan Facility to Accelerate Distribution of Solar Home Systems in Uganda

SolarNow, one of Arc’s partners under the USAID-funded REMMP initiative, announced a new $2 million loan facility from SunFunder. SolarNow is a solar distributor in Uganda that makes solar affordable through a 24-month payment plan. Through this business model, they can ensure that high quality solar be available to low income households. SunFunder has designed a Structured Asset Finance Instrument (SAFI), which allows SolarNow to finance its fast-growing portfolio of payment plans in Uganda.

ReadSunFunder began lending to SolarNow in 2013 with small, crowdfunded inventory loans. Through these initial loans, SolarNow established a repayment track record that helped enable SunFunder to unlock capital from accredited investors for larger and longer-term loans needed to match SolarNow’s growing working capital needs. In 2015, SunFunder extended facilities totaling over $800,000 of loans to SolarNow. The new SAFI facility builds on SolarNow’s strong track record in sourcing high-quality customers and extending credit on appropriately sized solar home systems based on customers’ energy needs and their ability to repay. The facility will scale SolarNow’s capacity to build and service such customers with contract terms in the future and multiply the positive impact SolarNow can make in the region.

“SunFunder has been a fantastic partner throughout this process,” said SolarNow’s Managing Director Willem Nolens. “With this financing in place, the board and management believe our business is now well placed to accelerate our growth in Uganda and beyond.”

“The launch of SAFI marks a new chapter in our long-standing relationship with a top-quality solar company,” said Audrey Desiderato, SunFunder’s Co-Founder and COO. “Starting with small crowdfunded inventory loans in 2013, we provided larger working capital facilities funded through our Solar Empowerment Fund. The launch of SAFI marks a next step in our relationship and aims to efficiently deliver scale. We are proud to announce this market-leading transaction with SolarNow and play an important role in their continued success in the market.”

About SolarNow

SolarNow offers a range of high-quality solar home systems and electrical appliances that are designed to fit the needs of rural households and entrepreneurs. Their solar home systems range 50 to 5,000 watts and because the systems are modular, customers can easily upgrade existing their systems to increase their system’s power capacity over time. The company offers a wide range of electrical appliances, including high quality LED lights, televisions, fridges, water pumps and flat irons. Through their network of 36 branches in Uganda and by extending appropriate credit to their customers for up to 24 months, SolarNow makes solar accessible and affordable for rural, low-income households and businesses. The company already installed over 10,000 solar systems in Uganda since 2011. These clients benefit from 5 years free service.

Press contact: Mr. John Kizito, Group Controller ([email protected], tel. 0788 916 641)

About SunFunder

SunFunder is a solar energy finance business with a mission to unlock capital for solar energy in emerging markets, where over 2 billion people live without access to reliable energy. SunFunder offers short-term inventory loans, working capital facilities and structured finance facilities to residential and commercial solar companies with a proven track record for quality and growth. SunFunder raises the capital for its loans through private debt offerings that give accredited investors an opportunity to invest in a diversified, vetted, and high impact portfolio of solar loans. The company aims to raise and deploy $1 billion into solar projects around the world by 2020.

Press contact: Mr. David Battley, Director of Structured Finance ([email protected])

Sogexpress’ Dominique Policard Appears on TV in the U.S. to Promote the Klere Ayiti Solar Remittance Program

Dominique Policard, Executive Commercial Director at Arc’s partner Societe Generale Haitienne de Transferts S.A (or ‘Sogexpress’), appeared Tuesday April 14th in a Miami television interview. The program, Teleskopi, was hosted by Gepsie Metellus, and was broadcast on Island TV, a channel targeted at the Haitian diaspora community in the U.S. Dominique talked about the Klere Ayiti initiative (Haitian Creole for “Light up Haiti”) which is an online platform that allows diaspora members to remit solar products back to families in Haiti, using the existing remittance network and architecture of Sogexpress in Haiti, and the Quick PaySM payment service of Western Union.

ReadDominique demonstrated four solar products on the remittance platform ranging in price from $55 to $180, described the options, price configurations and benefits of each, and explained the payment process. She described how a customer in the diaspora can place an order on www.klereayiti.com and then pay for the product at any participating Western Union using Quick PaySM services.

The focus of the interview was on the extensive benefits to customers in terms of education, health, security and livelihoods that have been tested and demonstrated over the course of Arc’s engagement with Sogexpress. The Klere Ayiti platform enables the Haitian diaspora to use remittances to finance renewable energy products for families and friends in Haiti, where a large majority of the population does not have access to electricity.

The platform features a dedicated website that allows diaspora-based customers to pre-order the solar light kit of their choice at www.klereayiti.com. They select the product and then use their order number to complete payment at participating Western Union Agent locations via the Western Union® Quick PaySM platform (present in over 174 countries around the world). Orders are fulfilled by Sogexpress in 3 to 5 working days.

All the products for sale have the capacity to recharge mobile phones, a highly desirable feature in Haiti, and were carefully selected by the Sogexpress team with the help of Arc Finance. All products come with a warranty by local distributors in Haiti.

The Klere Ayiti platform was launched in late July 2015 in Port-au-Prince and Miami. It was the culmination of many months of preparation and hard work by the Sogexpress and Western Union teams, and was made possible with support from the USAID-funded Renewable Energy Microfinance and Microenterprise Program (REMMP) and the Multilateral Investment Fund (MIF) of the Inter-American Development Bank (IDB).

Here at Arc, we’re delighted to see this program reaching the Haitian community in the U.S., and look forward to working with all the partners to increase clean lighting access in Haiti.

Commission on the Status of Women 60 Event, New York 2016

Arc participated at the Commission on the Status of Women 60 side event in New York on March 24. Organized in conjunction with USAID, this event explored “Clean Energy Financing to Expand Women’s Access to Energy: Promising Insights from India”. Laura Sundblad, Arc’s Capacity Building Specialist, described the range of financing mechanisms for clean energy including remittances; Niki Armacost, Arc’s Managing Director, described the findings from the USAID-funded Energy Diaries project; and Saiful Islam described Arc’s Energy Financial Literacy Program.

Investing in the Future We Want: Finance for Climate Change and Sustainable Development, New York 2016

Niki Armacost, Arc’s Managing Director, participated in the Investing in the Future We Want: Finance for Climate Change and Sustainable Development workshop on March 21 in Tarrytown, New York. Niki’s presentation during the “Wrap up and Closing Reflections” panel urged participants to think creatively about renewable energy investing.

Wall Street Green Summit, New York 2016

Wall Street Green Summit, March 14, 2016, in New York, USA. Niki Armacost, Arc’s Managing Director, led a panel discussion at the Wall Street Green Summit on March 14 in New York. In her presentation entitled “Green Microfinance and Asset Finance for Clean Energy”, she offered best practices on scaling renewable energy initiatives through microfinance and asset finance.

African Diaspora Symposium, Silicon Valley 2016

Arc’s Project Coordinator Yara Akkari participated in the African Diaspora Symposium in Silicon Valley in January. Yara shared valuable insight on the Klere Ayiti remittance initiative as an example of an innovative financing mechanisms involving diaspora that increase access to clean energy for poor people in developing countries.

Business Models that Leverage the Diaspora to Expand Energy Access

International diaspora Engagement Alliance (IdEA). Read article.

Crowdfunding and Energy Finance: New Platforms for Scaling Access to Clean Energy

Lack of access to affordable finance perpetuates global energy poverty. It limits both the supply and demand for energy products that improve people’s health, education, incomes and security. When energy companies that try to bring these products to consumers cannot get the capital to develop and commercialize new technologies, or in-house credit facilities, innovation is stifled.

ReadWhen regional distributors, networks, retailers and agents cannot purchase inventory because they don’t have the working capital they need, the supply chain cannot function. And if banks or MFIs don’t offer appropriate finance, improved energy products remain out of reach of those who need them most.

What we see here is not one deficit, but a series of deficits. What they have in common is a shortfall of various capital coming into an industry in which demand is massive – and growing. To address these deficits, new ‘crowdfunding’ models provide alternative means by which energy suppliers and consumers can access the finance they need, beyond the traditional triumvirate of donor/grant support, debt, and equity investments. Raising money in small amounts from the public – the ‘crowd’ – isn’t new: charities and religious entities have been doing it for centuries. But crowdfunding via online platforms involving a pool of funders that is potentially global in scope for high social impact purposes in developing nations is definitely something new and different, and potentially game-changing.

What is the “Crowd,” and What Is It Funding?

In general terms, “crowdfunding” describes the practice of raising funds in small increments from large numbers of non-institutional sources. Typically, activity is mediated via an online platform and promoted through social media. While a handful of popular crowdfunding websites such as Kickstarter, Indiegogo and RocketHub continue to maintain market share and command considerable brand recognition, hundreds of other platforms occupy an increasingly segmented, specialized and competitive online marketplace through which over US$5 billion had been raised as of last year.

Crowdfunding’s appeal is its potential to unlock new sources of funds for purposes that conventional sources of investment and charitable giving are generally unwilling or ill-equipped to support, or even incapable of identifying in the first place. However, in addition to realizing greater funding availability, crowdfunding usually offers important cost and flexibility advantages as well. Funds sourced through platforms from informal networks of personal contacts (“friends and family”), shared interest communities and consumers are typically less expensive and impose fewer demands and expectations on fund-seekers compared to conventional private, public or charitable sources.

Crowdfunding in Practice

For this reason, crowdfunding has gained interest in providing low-cost, high-quality energy services to the world’s Energy Poor. Indigogo, based in San Francisco, is one of the world’s leading commercial crowdfunding platforms. Since launching in 2008, over US$100 million has been raised through Indiegogo’s website for over 275,000 campaigns in over 200 different countries. Indiegogo is a for-profit, private company that generates revenue by charging a fee to users of its platform. Fees are based on the amount of funds that users raise. While many campaigns support creative/artistic projects and new commercial technologies and products, the platform has also become a popular choice for social enterprises, non-profits and charitable campaigns that are explicitly focused on affecting positive social outcomes. Indiegogo places virtually no restrictions on who can raise funds and for what purpose, provided that the campaign initiator has a bank account and that the intended funding objective does not break any laws.

Campaigns that reach their goal pay a fee equal to four percent of the total amount raised, whereas campaigns that do not reach their goal are charged a nine percent fee. Indiegogo charges no entry or membership fees to use its platform, and campaigners only pay the company if and when they raise money. Campaigners are required to make some investments, such as a short campaign video. However, the scale of investment in both time and money are entirely up to the campaigner.

The company’s business model means the incentives of the company and the campaign are aligned: it has a direct stake in helping members reach their goals. It incentivizes success by increasing the visibility and audience of campaigns that register the highest level of funding activity. Indiegogo’s proprietary algorithm, “Gogofactor,” measures funding activity and elevates successful campaigns to featured spots on the homepage, increasing passive exposure by site visitors. In addition, various tools, tips and suggestions for success based on best practices can be found and accessed for free on Indiegogo.com.

Kiva is by far the best-known philanthropic P2P crowdfunder. Set up in 2005, it was created to enable individuals to lend mwww.kiva.orgividual micro-entrepreneurs via its website. Kiva partners with MFIs, community-based organizations and private companies to facilitate the provision of loans to individuals or small groups of borrowers. The borrowers repay the partner, which repays Kiva, which repays the lender. While the lender is lending at zero interest, the vast majority of loans are then recycled and kept in the system. In this sense, these small loans are de facto donations. As of last year, over one million online lenders had lent over US$691 million to 1.2 million borrowers. It works with 297 different field partner organizations and businesses in 86 countries worldwide.

One aspect of Kiva’s model which distinguishes it is the low risk aversion of its lenders, which allows it to experiment more than a commercial lender can, and this is allowing a steady diversification of its lending activities beyond conventional finance for micro-entrepreneurship to include consumer and SME finance, and its “Kiva Labs” initiative, which allows more rapid testing of new ideas, with lower due diligence requirements: the ‘testing’ is a form of due diligence itself, according to Kiva.

In response to demand from field partners, Kiva has also expanded into several new, high-social-impact verticals. In 2011, the term “Green Loans” was coined to describe diverse forms of Kiva lending that support both entrepreneurial and consumer investments that result in positive environmental impacts. Renewable energy and energy efficiency loans have emerged as an important segment within this new and growing category of Kiva lending. So far, Kiva’s green borrowers have received loans to finance energy efficiency upgrades and the installation of low emissions cook stoves at home (Mongolia); the purchase of domestic solar hot water heating systems (Palestine); and investments in biomass digesters that convert agricultural waste into both clean cooking fuel and organic fertilizer (Mexico).

Another lending platform is Milaap, an Arc Finance partner based in Bangalore. Founded in 2010 by three entre¬preneurs from the microfinance, off-grid lighting and mobile technology fields, Milaap raises loan capital for Indian microfinance institutions (MFIs) engaged in specifically energy, education, clean water access and other forms of essential service lending. By channeling low-cost, flexible loan capital from both online and offline lenders to a select group of MFI field partners, Milaap aims to overcome critical cost barriers that keep such services out of reach for millions of low-income Indian businesses and households. Milaap’s broader mission is to demonstrate the viability of essential services lending to the wider Indian microfinance sector and its commercial funders.

By early 2015, Milaap had raised and channeled over US$4 million into a diverse portfolio of over 26,000 loans, impacting the lives of over 100,000 people, while maintaining a 100 percent repayment rate from field partners – figures which have further grown in the year since. Funds are raised from an increasingly global crowd of lenders and disbursed to borrowers across ten Indian states through a network of 15 different field partners. The company’s energy portfolio continues to advance through its active partnerships with three microfinance institutions based, respectively, in the states of Orissa, West Bengal and Manipur. Due to the comparatively small size of loans for clean energy products such as solar portable lanterns and improved cook stoves, energy represents only ten percent of Milaap’s total portfolio. However, with over 2,000 borrowers financed to date, energy accounts for nearly one quarter of all loans disbursed.

Milaap’s “retail lending” model shares much in common with Kiva’s peer-to-peer approach. Milaap also works through a growing network of field partners that includes non-profit, community-based microfinance organizations as well as private companies. One hundred percent of funds provided by lenders goes towards borrowers, and, like Kiva, Milaap sees very high rates of relending, enabling the company to continuously revolve funds.

However, there are important differences. Milaap is a private social enterprise that operates on a for-profit basis. The company generates revenue by applying a small interest fee (typically five to eight percent) to field partners that receive and disburse the credit that it provides. Unlike Kiva, Milaap is exclusively focused on India, at least at present. And while Kiva’s energy-access lending can be seen as part of a broader portfolio diversification that occurred organically over time, energy lending has been a core part of Milaap’s vision since the company’s inception. Indeed, Milaap was launched for the explicit purpose of providing capital for unconventional “essential service” loans, such as energy lending, that mainstream commercial institutions and wholesale capital providers commonly view as high risk and therefore tend to eschew.

Milaap capital is flexible because the company does not dictate to field partners either the interest rates or terms that it must offer to its clients. This can translate into a variety of different benefits for partners and borrowers: loans can be structured in different ways to increase affordability, and thus bolster demand, as well as the ability to pay, among borrowers.

A final example of an online platform being used to fund renewable energy is SunFunder – a US-based private solar financing company that sources low-cost, short-term debt for solar companies operating in off-grid, emerging markets. To date, the company has maintained a focus on East Africa and has recently expanded to India. In contrast to Milaap and Kiva, which focus on providing loans to end-users and energy micro-entrepreneurs, SunFunder aims to meet the comparatively larger working capital and project finance requirements of established solar SMEs. Its website is designed to simplify the process of project review, selection and oversight, and to be as simple as possible for lenders as well, allowing credit card or Paypal-based payments. The minimum investment that lenders can make is US$10, and the maximum is whatever amount remains unfunded. Like both Kiva and Milaap, lenders are repaid on a monthly or quarterly basis.

SunFunder is still a start-up, but in the long run, it aspires to secure capital for off-grid solar companies through a variety of different means, and has deployed crowdfunding as a means of rapidly entering the space, and to demonstrate the bankability of off-grid solar companies to a wider field of lenders and investors. In this sense, SunFunder uses crowdfunding as a strategic bridge to larger sources of investment. One SunFunder loan recipient is the solar lantern distributor SunnyMoney, which, with more than one million units in sales, is the most prolific distributor of retail solar products in Sub-Saharan Africa.

Sunfunder’s mission is to ensure better debt funding through crowdfunding and also directly from private investors: SunFunder blends funds raised from its online platform with capital that it raises from accredited and institutional investors in the form of Solar Empowerment Notes (SENs) - a debt instrument that, unlike funds raised through the crowd, offer a financial return. SunFunder closed its first issuance SENs in September 2013, raising US$250,000 from four separate investors.

SunFunder generates revenue by charging a one-time capital sourcing fee to all borrowers and nine percent to 15 percent interest on all funds disbursed. Unlike Kiva and Milaap, the company does view the ultimate prospect of sharing profits with its network of lenders as a long-term goal, once regulatory reforms permit. SunFunder currently does, however, enable lenders to direct the reinvestment of interest gained to subsequent borrowers through its impact point program. In short, impact points represent small amounts of interest that are repaid with principal to the lender; while that interest cannot be withdrawn by lenders, it can be added to additional investments made by the lender.

Crowdfunding’s Role

Crowdfunding is unlikely to ever solve, alone, the demand for low-cost capital in the small-scale energy finance sector. It requires an investment in time and effort – far beyond putting a campaign or some beneficiaries on a website. Further, campaigns must be focused in order to succeed.

The focus of campaigns is critical to success, with a specific product orientation and if possible, rewards for lenders. If this is done, the benefits of crowdfunding can extend beyond capital to include valuable promotional and marketing benefits. By nature, crowdfunding is audience-driven and the ability of fundraisers to clearly and persuasively articulate and promote their ideas and products to large numbers of people drives success. So increased exposure to companies, projects, products and ideas can bring future customers, investors and media attention that can be leveraged further than small donations or loans alone. And if one thing is clear, it’s that bringing to a global audience the nature of energy poverty and the exciting affordable solutions to it which now exist, can be an important part of the expansion phase this sector is now in.

Boond and Simpa Networks Recognized for Innovation in Indian Clean Energy Space

Boond, a friend and ally of Arc Finance and a social enterprise organization expanding alternative energy in Rajasthan, Uttar Pradesh, and other northern states of India, was recently invited to join Indian Prime Minister Narendra Modi in San Francisco as he gave a speech highlighting innovative Indian start-ups that focus on clean energy and technology.

ReadThe Prime Minister addressed entrepreneurs and technology leaders in Silicon Valley as part of the day-long event promoting the “India-US Startup Konnect 2015,” a program to promote and further develop the strengths of India’s start-up ecosystem and encourage Indian-US collaboration. Organizers Nasscom and the Indian Institute of Management-Ahmedabad’s Centre for Innovation, Incubation and Entrepreneurship (CIIE) nominated Boond for this significant honor. Simpa Networks, an Arc partner under the Renewable Energy and Microfinance Microenterprise Program (REMMP), has also been in the news this week, winning the WWF Climate Solvers and Savers award by WWF India in Delhi. Simpa is a pioneer in enabling thousands of Indians to access affordable clean energy through a proprietary pay-as-you-go model called “Progressive Purchase,” and was one of two winners in the Energy Access category, recognized for its innovative business model by a diverse group of government officials and public sector stakeholders. After winning the award, Simpa was congratulated by Shri Prakash Javadekar, the Indian Minister of Environment, Forest & Climate Change, in a video message conveyed during the award ceremony. We’d like to congratulate both of these remarkable organizations for their recent successes, and fast-growing international reputations. They represent just a small glimpse of the innovation and entrepreneurship underway in the Indian clean energy space today.

Films on Utkarsh and Sogexpress Selected as Finalists at the Off-Grid Experts Awards 2015

We are excited to announce that two videos featuring Arc Finance partners have been selected as among the top four finalists for the Off-Grid Experts Awards 2015 – organized by Phaesun and taking place in Memmingen, Germany September 25 to 26. Over the course of the Off-Grid Experts Workshop 2015, all top four films will be shown to workshop visitors, who will vote on the winner at the event. Both videos are finalists in the “Filmlet-Energy Independence” category.

ReadArc Finance’s profile of microfinance institution Utkarsh’s solar lending program, “Utkarsh Brings Light to Uttar Pradesh, India,” was shot by our photographer and videographer Souradeep Ghosh, and was produced as part of our Renewable Energy Microfinance and Microenterprise Program (REMMP), which is funded by USAID. “Remittances and Solar Energy,” our profile of Haitian money transfer org Sogexpress’ remittance and energy program, is a result of a public-private partnership between Arc Finance, Sogexpress and the Multilateral Investment Fund (MIF) of the Inter-American Development Bank (IDB), and the filmlet was funded by the MIF/IDB. The video highlights the key innovation of using remittance corridors to finance clean energy products.

We are delighted for Utkarsh, Sogexpress and all the other entities involved in the production of these two informative, elegant and warm films, which show the impact that small-scale clean energy can have on people’s lives.

We congratulate all finalists in all categories, and send our thanks to our digital media team, our partners, and the talented Souradeep Ghosh for all their work in getting us this far!

Innovations in Financing Event, NYC 2015

This series of four videos captures a full-day 2015 workshop entitled “Innovations in Financing: The Nexus Between Energy, Distribution And Finance.” Organized by Arc Finance in conjunction with USAID, the day featured stakeholders from across the sector discussing the latest innovations in consumer and institutional finance for providing small-scale clean energy access to the poor.

Watch our video series. ►

Innovations In Scaling Off-Grid Clean Energy Event, Washington, D.C. 2015

This series of seven videos captures a full-day 2015 workshop entitled “Innovations In Scaling Off-Grid Clean Energy: Business Models to Promote Consumer Financing.” Organized by Arc Finance in conjunction with USAID, the day featured stakeholders from across the sector discussing the latest innovations in scaling off-grid clean energy access to the poor. Watch our video series. ►

MIF Supports Scaled-up Program Using Remittances to Fund Renewable Energy in Haiti

Multilateral Investment Fund. Read article.

Lighting up Haiti: Solar Kits Are Sent to the Island

Latin Correspondent. Read article.

Haiti’s Electrification Issues Have Been Solved by Solar Power Light

Atlanta Black Star. Read article.

Solar Power to Light Up Communities in Haiti

Miami Herald. Read article.

Western Union and Sogexpress Innovate: Remittances to Fund Renewable Energy in Haiti

Digital Journal. Read article.

Western Union and Sogexpress Innovate: Remittances to Fund Renewable Energy in Haiti

MarketWatch. Read article.

Western Union and Sogexpress Innovate: Remittances to Fund Renewable Energy in Haiti

Business Wire. Read article.

Western Union and Sogexpress Innovate: Remittances to Fund Renewable Energy in Haiti

The Western Union Company (NYSE: WU), a leader in global payment services, and Western Union Agent Sogexpress, a leading Haitian money transfer and payment services company and subsidiary of Sogebank, today launched a new platform that enables the Haitian diaspora to use remittances to finance renewable energy products for families and friends in Haiti, where only 28 percent of the population has access to electricity. Read press release.

Western Union et Sogexpress lancent un nouveau produit dénommé: “klere Ayiti”

Référence Haiti. Read article.

Klere Ayiti et le défi de l’énergie en Haïti

Le Nouvelliste. Read article.

Arc Finance and Sogexpress Launch KlereAyiti.com

Arc Finance and Sogexpress launch KlereAyiti.com, a new platform for financing clean energy in Haiti through remittances.

ReadArc’s partner the Societe Generale Haitienne de Transferts S.A (Sogexpress), a leading money transfer and payment service company in Haiti, and the Western Union Company, a leader in global payment services, have launched a new platform called Klere Ayiti, Haitian Creole for “Light up Haiti.” This platform enables the Haitian diaspora to use remittances to finance renewable energy products for families and friends in Haiti, where a large majority of the population does not have access to electricity. This collaboration expands on a pilot implemented from 2012 to 2013 by Arc Finance with support from the Multilateral Investment Fund, a part of the Inter-American Development Bank Group (MIF/IDB).

The platform features a dedicated website that allows local customers and senders living abroad to pre-order the solar light kit of their choice at www.KlereAyiti.com. They then use their order number to complete payment at participating Western Union Agent locations around the world via the Western Union® Quick PaySM platform (present in over 174 countries around the world). Orders will be fulfilled by Sogexpress in 3-5 working days.

This platform was launched in late July 2015 in Port au Prince and Miami, the culmination of many months of preparation and hard work by the Sogexpress and Western Union. The process involved market research, product selection, website construction, adaptation and development of IT and web platforms, marketing and promotion. The platform will provide an enormous opportunity for innovation in using an established remittance corridor to finance renewable energy in the poorest country in the Western hemisphere.

Only 28% of the Haitian population has access to grid electricity , and the 2010 earthquake was devastating in both human and economic capital. The country receives a considerable percentage of its GDP in remittances (over 20 percent of GDP ), with a huge diaspora population living in the US – about 420,000 Haitians live in the New York area alone. Thus, Haiti was an idea choice to test remittances as an end-user financing and distribution mechanism in the 2012-13 pilot phase, and the success of that program has led to its current expansion stage.

The results of the pilot phase were encouraging, and led to a joint venture between USAID and the IDB’s Multilateral Investment Fund to fund Phase III, which will, after months of careful review, provide the Sundaya T-Lite for purchase exclusively at Sogexpress e-commerce site at KlereAyiti.com. The T-Lite is a modular solar light kits, available as a kit with two or three lights, will be sold for US$140 and $180.

Both systems have the capacity to recharge mobile phones, a highly desirable feature in Haiti. Awango by Total, an initiative of the company Total to market affordable solar lamps in developing countries, is committed to bringing only the highest quality products to Sogexpress customers and backs this assurance with a two-year warranty. The selected systems have been sold in more than 16 countries, with total sales exceeding 600,000 units.

Already, training delivered by Sogexpress, Awango by Total, and Arc Finance in February 2015 has increased the capacity of Sogexpress sales staff to effectively market, sell, and service the Sundaya T-Lite products that will be sold through the remittance platform.

Staff from all 57 Sogexpress stores were trained on the Sundaya products to ensure the staff had optimum knowledge of the lamps’ features, use, and after-sales service, through ongoing training throughout the course of the program, recognizing the importance of client satisfaction in the success of this initiative.

This exciting new program will target 5,000 sales across the remittance platform, with marketing reaching 300,000 existing remittance senders in the Diaspora and 500,000 recipients in Haiti through an awareness-building campaign, which will use energy literacy and promotional programs to educate Haitians both at home and in the diaspora on the economic and social benefits of switching to clean energy products.

Arc Finance and USAID Reach 100,000 Clients Milestone under REMMP

The Renewable Energy Microfinance and Microenterprise Program (REMMP), implemented by Arc Finance and funded by USAID, has passed a key milestone: as of May 30 2015, REMMP’s partners have provided more than 100,000 households with access to clean energy products such as solar lanterns, solar home systems (SHS) and efficient cookstoves. REMMP partners work in India, Uganda, Kenya and Haiti, and with an average household size of five people, this means that over half a million people in those countries now have access to lighting, power and safe cooking thanks to the initiative.